Recent developments in the residential real estate sector show that many regions and segments are gradually becoming active again.

After a period of stagnation due to various factors such as limited supply, high interest rates, and legal obstacles, a wave of projects is now eligible to launch sales amid historically low deposit interest rates. As other investment channels become riskier, both investor confidence and demand for real estate are surging once again.

Speaking at a recent real estate event, Mr. Nguyen Van Dinh, Vice Chairman of the Vietnam Real Estate Association, stated that since the beginning of the year, there have been around 100 kickoff events, project launches, and sales openings, with transaction volumes clearly on the rise.

According to real estate platforms and individual brokers, Hanoi’s condominium segment has been chaotic in terms of both pricing and buyer traffic, while demand for individual land plots and houses has also risen sharply. In some areas, people have been queuing early at notary offices to secure a spot for completing property transactions. Events organized by developers—such as project introductions and product launches—have drawn large crowds of interested buyers and registrants.

Beyond Hanoi, several newly launched projects in nearby provinces have also attracted strong interest and achieved sales results beyond initial expectations.

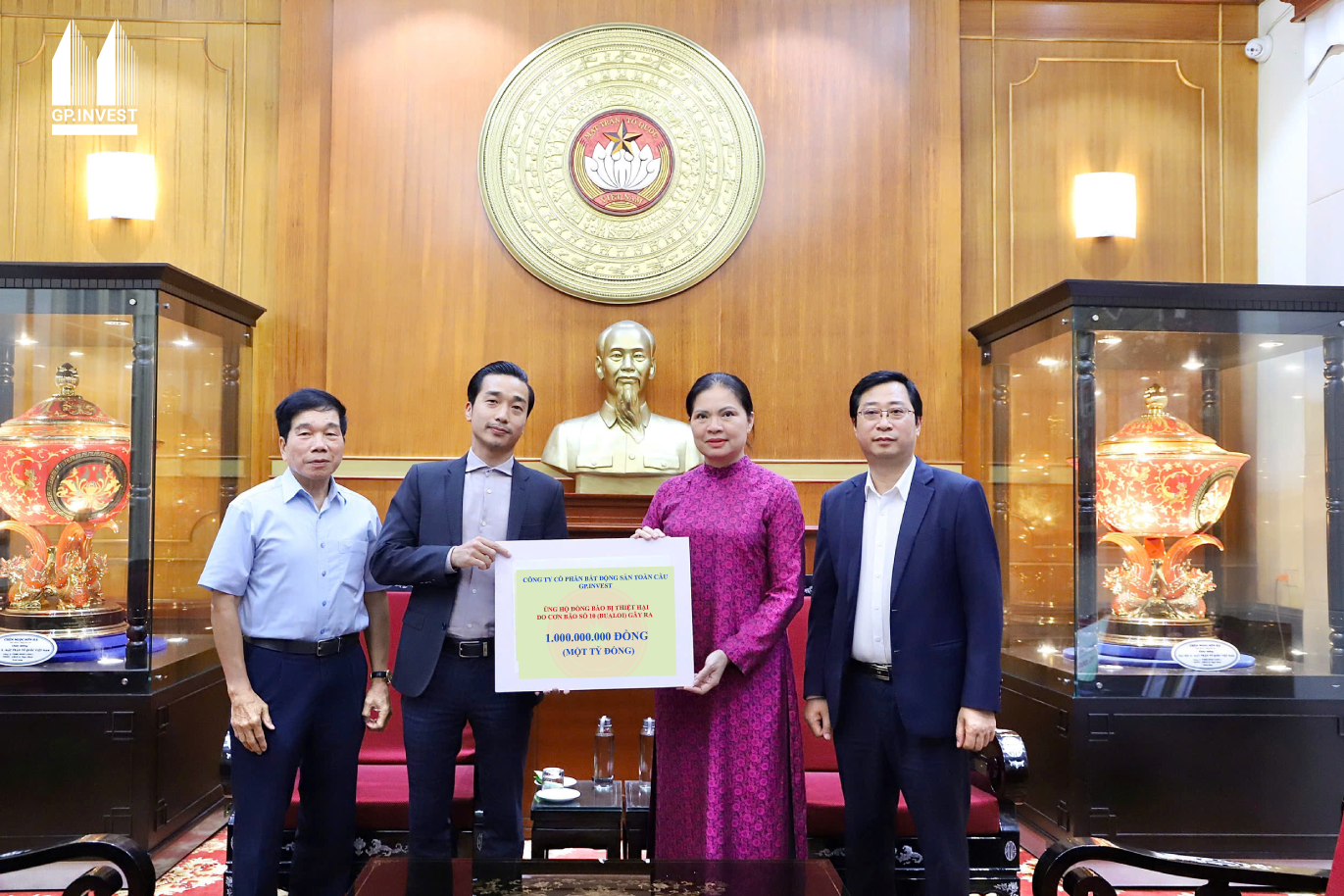

One standout event was the Phase 1 sales launch of the Palm Manor urban project in Viet Tri City, Phu Tho, developed by GP.Invest, which took place on the afternoon of April 6 and drew hundreds of interested customers. The project has a total investment of 6,500 billion VND and spans 56.4 hectares. It is currently in Phase 1, covering 28.4 hectares with an investment of approximately 4,000 billion VND, including infrastructure, green parks, water regulation lakes, public squares, and 676 low-rise residential units.

In this opening phase, Palm Manor introduced 66 villas, townhouses, and shophouses to the market, priced from 4.8 to 20.5 billion VND (including rough construction and finished exteriors). According to the developer, after just two days, most of the units had been sold, with some buyers acquiring multiple properties for both living and investment purposes.

Many experts believe that the most difficult phase for the real estate market is over, and recovery could begin by mid-2024. However, they also predict that property prices will rise during the recovery phase. With current trends, the market is expected to return to normal operation and enter a safe, healthy, and sustainable growth cycle starting from the second half of 2024, paving the way for stronger expansion from early 2025 onward.